Note: This article has been authored by Taylor Cottam. Weâve interviewed Taylor before but for some background, Taylor has managed financial risk and traded fixed income products inside both GMAC bank and other financial institutions in Europe, North America and Canada. He is also the author of Economy Politics, numerous business and economic articles, is a CFA Charterholder, a Certified Financial Risk Manager (FRM) and holds an MBA from INSEAD.

When the Fed lowered the interest rates for overnight borrowing to near zero, it was said to be a measure to stimulate the seized credit markets. Low interest rates stimulate borrowing. On the demand side that is true. On the supply side, it is clearly not the case.

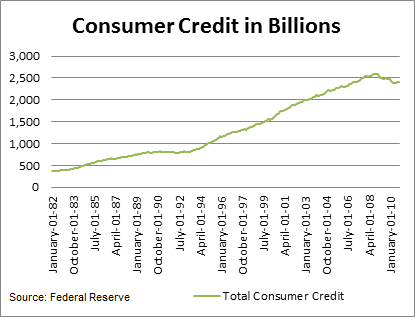

The financial crisis woke America up from years of binge borrowing and now the credit hangover to deal with. So while low interest rates were appealing for those who wished to refinance their existing debt, there was no interest rate low enough that would tempt them to take on new debt to finance consumption. The deleveraging process limited the chance of success of an interest rate solution.

The country had almost overnight turned from a marginal borrower to a marginal saver.

One of the things that people forget is that low interest rates, while good for the borrower is not good for the saver.

Consumers need to deleverage their own balance sheet and the Federal Reserve, by holding rates artificially low, not only stimulates too much borrowing, but also stimulates too little savings. That savings will go towards further investment. More savings, with a less steep yield curve will force banks to start lending more. In fact, that is one of the biggest dichotomies. A steep yield curve, while good for the stock market, does little for the credit market.

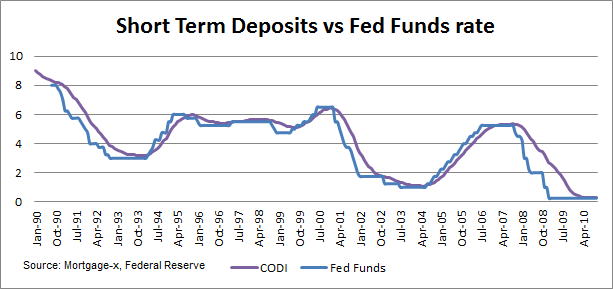

“But doesnât my bank set the interest rate?”, you might ask. Is it really true that the Fed sets short term rates? Yes it is. If you look at the short term deposit rates as measured by the Certificate of Deposits Index (CODI) against the Federal Funds rate, we see actually how much control the Fed has over that rate that you and I receive on our savings and checking deposits.

The CODI takes an average of three month term deposits and tends to very closely mirror average rates for demand deposits and the interest rate on short term savings.

Of course, we canât complain directly to the Fed, we can only call up our bank. The bank will say itâs the market rate, which of course is true, but that begs the question on how we have allowed a committee of technocrat PhDs to become the de facto short term rate setter? What if we had banks themselves set the short term overnight deposit rate? The real question that you have to ask yourself, is what should our short term interest rates be without the intervention of the Federal Reserve.

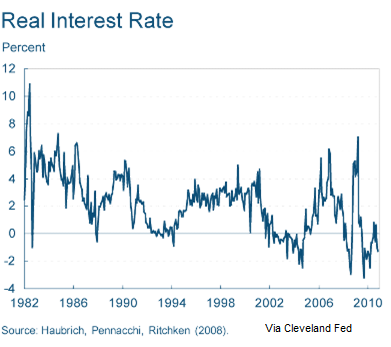

With short term rates near zero, that brings, real interest rates, which are the nominal rate less inflation, into negative territory. With CPI inflation at 1.1% and short term rates near zero, that leaves real rates near -1%. While I am not smart enough to know what the true market rate would be, I can tell you that negative real interest rates are nothing healthy. They have typically only existed in high inflationary times like the late 70s early 80s. Now negative real interest rates are back. They are not back because inflation is too high. They are back because nominal interest rates are too low.

Negative real rates and nominal rates near zero, give an open invitation for other countries to start using our currency as the patsy. Hence, the carry trade is alive and well with companies and hedge funds borrowing in the US and funding their investments overseas. Japan tried the negative real interest rates for years to get their economy going with little to show in terms of domestic growth.

What should rates be?

My view is that short term rates should be closer to 2%. Iâm not Mr. Market so I canât give the exact number. KC Fed chief and long-time critic of the current policy has called for the Fed to reset the short term rates to 1%. Economist Steve Hanke of Johnâs Hopkins suggested 2%. I think even 1% is low because that still doesnât bring the real cost of money above zero.

That brings cash onto the balance sheets of banks. That leads me to one of the misconceptions in this crisis. Banks are not just sitting on a ton of cash, they are also sitting on a ton of potential bad debts. They are not cash rich, they are cash poor.

The effect of raising rates brings the real interest rate above zero and actually incentivizes people to start saving again. More savings means more cash on bankâs balance sheets. Not until we solve the banks balance sheets will they be willing to invest once more.

{ 0 comments }