According to the fourth annual Investors Group RRSP Exit Poll, the 2009 tax year saw increases in the number of Canadians making contributions to Registered Retirement Savings Plans (RRSPs) and Tax Free Savings Accounts (TFSAs).

Always curious to probe the insights of professionals in the investment industry, I extended an invitation to Debbie Ammeter, Vice President, Advanced Financial Planning Support, Investors Group to answer a few questions about the Investors Group RRSP Exit Poll.

Biography: Debbie Ammeter is Vice-President, Advanced Financial Planning Support at Investors Group, and has more than twenty-five years of experience in the financial services industry, focused on law, taxation, trusts and estate planning. Debbie is a lawyer who holds the Certified Financial Planner certification.

Q: Ms. Ammeter, why do you think there was a rebound in the number of Canadians making contributions to Registered Retirement Savings Plans and Tax Free Savings Accounts? Is it because the markets have rebounded with vigour after bottoming in 2009 and people are scrambling to get a piece of the action or is because the economic reality doesn’t appear so dire anymore – at least in the headlines?

A: Yes to both. The TSX composite index has risen nearly 60 per cent since the March 9th, 2009 record low close just over one year ago. And Canadian consumer confidence continues to strengthen.

The latest Investors Group-Harris Decima Index of Consumer Confidence shows that Canadians are three times more likely to see good times financially for themselves a year from now than bad. As well, 30 per cent of Canadians see good times ahead for the economy compared to 13 per cent who anticipate bad times.

Q: If someone had to choose between putting money into a RRSP or a TFSA, what are some of the factors that you evaluate? Are some investments more amenable to be put in TFSA’s than RRSP’s?

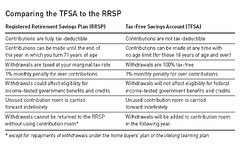

A: At a very basic level, RRSPs and TFSAs are excellent tools that help you meet different types of financial goals. One factor to consider is whether you might need to access the monies over the short term and for what purpose. Funds can be withdrawn from your TFSA at any time without tax consequences and recontributed in any future year without using up new TFSA contribution room. Amounts withdrawn from an RRSP are taxable and the RRSP contribution room is generally lost (unless you are making withdrawals under the Home Buyers’ Plan or Lifelong Learning Plan). So a TFSA is more useful for investments that you think you might need to access and for shorter term goals, such as an emergency fund or saving for a major purchase. But for long-term retirement savings, RRSPs are very attractive because of the tax deduction provided by the RRSP contribution. I’ve included a chart below to help highlight the differences between the two.

Another factor to consider if you have to decide between an RRSP and a TFSA for retirement saving is your expected tax rate at the time of contribution and your expected tax rate during retirement. If you expect to be in a lower tax bracket after you retire, an RRSP may be best. But a TFSA may be better for you if you expect to be in an equal or higher tax bracket after you retire. A TFSA is also useful because monies withdrawn from the TFSA do not affect any income-tested benefits or credits like the Old Age Security benefit and the Age Credit.

Q: Ms. Ammeter, why do you think more people made contributions to RRSP’s and TFSA’s this year but the percentage of Canadians choosing to “park” their RRSP contributions in short-term and typically lower risk vehicles remained the same as last year? What did Investors Group take away from this statistic?

A: There is no doubt that Canadians are returning to investing as indicated by the increases in the number of Canadians who say they contributed to RRSPs and those who say they invested in TFSAs.

Some short term “parking” of investments is a normal part of RRSP season. The fact that these poll results have not changed year-over-year indicates that Canadians may still be feeling cautious, but the trend is toward returning to investing for the longer term.

Parking your investment while you decide how to allocate can be a reasonable strategy – as long as it’s for the short term. Leaving the money parked for longer periods of time runs the risk of missing out on growth opportunities.

Q: What are your thoughts (benefits and drawbacks) on taking on RRSP loans to make contributions? Is this not a good idea for people with pre-existing debts like student debt and credit card debt?

A: Borrowing to top up your RRSP contribution can be an effective way of maximizing your contribution room, boosting your tax refund and getting more retirement savings to work for you sooner on a tax-sheltered basis.

But the key to deciding whether to use this strategy is how much debt you’re already carrying and whether you can afford another loan. Work with a financial advisor to help assess whether an RRSP loan is right for you. Also, if you take on an RRSP loan, use the tax refund generated by your RRSP contribution towards paying down the loan.

Q: Ms. Ammeter, what are some Retirement Savings strategies for all ages and can you perhaps highlight some of the special challenges being faced by various demographic groups such as small business owners and boomers when it comes to saving for retirement?

A: Retirement planning strategies should vary according to an individual’s risk tolerance, financial situation and life stage, but I believe that your retirement plan is best considered in the context of an overall financial plan which deals with all of your financial life goals. A financial planner can develop a customized plan to reach your financial goals, considering the cornerstones of cash management, investment planning, risk management, tax planning, retirement planning, estate planning and planning for any other special needs.

Having said that, a financial planner will consider the following items in developing a retirement plan:

1. Your desired retirement lifestyle.

2. Your retirement income needs, which will be determined in part by your desired retirement lifestyle, and how they compare to your projected retirement income, based on your expected sources of retirement income.

3. Strategies which can be used to fill any gap between your retirement income needs and expected retirement income, such as saving more, reducing retirement expenses, retiring later or phasing into retirement and accessing other assets for retirement income.

There are also life-stage specific opportunities to consider:

The twenties and thirties are an excellent time to start saving for retirement, as you have time on your side to develop retirement resources. But people in this age group may be starting out, carrying debt, and for various reasons feel they have no extra monies to invest in their retirement. If so, this is the time to work with a financial advisor to help you develop a cash management strategy to best allocate your scarce resources between your competing financial goals. Dollars allocated to your RRSP during your twenties and thirties go farther towards accumulating retirement resources.

If you are at a stage in your life whether you are no longer supporting dependents and where your debt is paid off, you may be able to significantly increase your retirement savings. Many baby boomers may be in this fortunate situation. If so, this is also the time to work with a financial advisor to optimize your retirement plan.

The retirement income of a business owner is often generated from corporate investments and the proceeds of sale of the business, in addition to the RRSP and TFSA savings. The owner of an incorporated business also has more planning opportunities to consider, such as the ability to establish an Individual Pension Plan. Sifting through the options and dealing with issues such as the sale of the business is complex. The business owner needs to discuss retirement planning with a financial planner well in advance of retirement and any possible sale of their business.

Q: What sets Investors Group apart from other wealth management firms in helping people plan and save for retirement?

A: Investors Group believes that financial plans and retirement plans are unique to each individual. Our business model is focused on an enduring one-to-one relationship between an Investors Group Consultant and a client.

The key to successful financial and retirement planning is understanding the goals and needs of the client and then constructing a personalized plan to help achieve those goals.

It is also important that a personal financial plan is reviewed on a regular basis. Typically, a person’s needs and goals change as they move along life’s path, and their financial plan should reflect these transitions and life events.

Investors Group has more than 4,600 Consultants living and working in communities across the country. Investors Group itself has been active in the financial and investment planning industry for more than 85 years and has helped Canadians achieve their long term goals through all kinds of market and economic conditions.

Thank You, Ms. Ammeter!